We all know it, the world can be complicated. It’s tough to manage all the aspects of our lives and easy to become zombified by the constant stream of things to do, thus we go on autopilot.

One of the things we love to run on autopilot are our automatically renewing insurance policies. Even as a insurance agent, I can tell insurance isn’t something you typically think about on a daily basis. It only comes up when we have a specific goal of some kind.

Even if you don’t have specific goals however, not shopping for insurance is just plainly financially irresponsible as this article will show.

1. Insurance Companies Profit the Most Off Old Policies By Design

Here is something that rarely happens. Your insurance policy is set to renew, and the cost goes down.

Why do older, and apparently more loyal customers get charged more is a good question. Shouldn’t older customers be rewarded with lower premiums? In most industries and business this is the right attituded, but when it comes to insurance, this simply is not the case.

Insurance providers uses statistical data to calculate the risk of losses and events that harm the insured’s, and therefore the insurers interest. Premiums set by insurance companies are based on numbers that let them stay in business while they are paying hundreds of thousands of dollars to people filling insurance claims.

“But what if I don’t do anything that would make my insurance rate go up? Why would my insurance premium go up if I’m still the same driver in the same location who was offered a lower price before?”

The answer to this question is in the insurance company’s strategy to get more customers. Companies will initially offer lower rates to attract more customers. You can best see this in effect in marketing from big insurance companies, like Gieco.

“Save 15% or more on car insurance, when you switch to GEICO”

Insurance providers bet on people switching due to price, so they lower their profit in order to attract customers, but over time they will push up the price to regain that profit, and if you aren’t savvy to this, you may not notice that your insurance may have doubled in the last couple years.

So: the reason Insurance companies don’t give much in renewal discounts is because new policies are less profitable than mature ones. The mature policies become more profitable over time and give profit to companies and allow them to subsidize losses at new business. Many consumers decided to stay with the company because they don’t see an increase in premiums over years. Insurers uses this complacency to build value.

2. Not All Insurance Providers Look At Things In The Same Way

Insurance companies generally categorize their customers into three tiers based on how risky they have calculated it is to insurer given customers.

- Tier 1: Preferred

- In the first tier are clients that have been determined to not be large risks to cover. All other things being equal, this tier gets the lowest rates. The people in this tier are over 25 and under 50 years old with long and clean driving histories and backgrounds, live in a safe area, have assets and property that are easily replaceable, and don’t engage in risky behavior.

- Tier 2: Standard

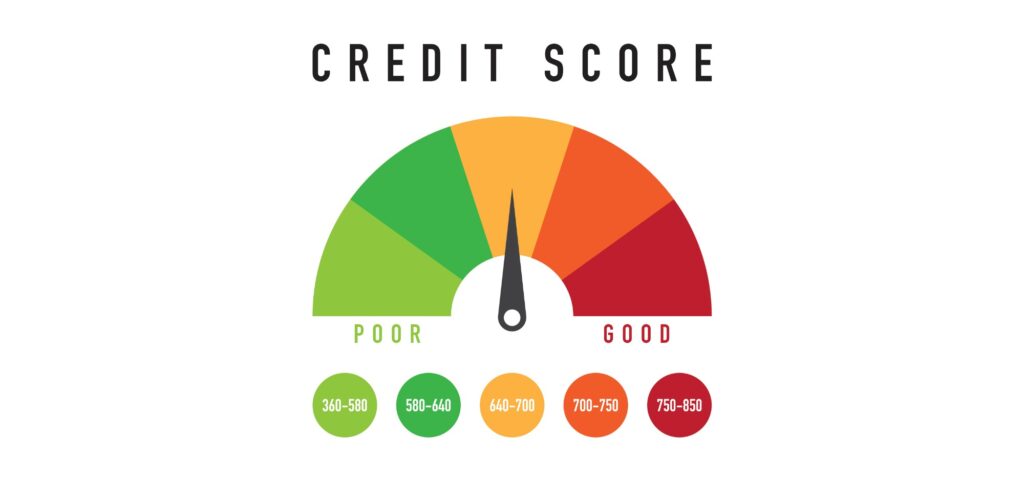

- The second tier includes most people. It’s not necessarily damming to be in this tier, as good rates are still possible. People in this tier may only have a couple of violations or accidents. They may not be of the right age or in right location. It’s possible to improve their tier if they remain diligent when driving, maintain no lapse in coverage, and raising their credit score.

- Tier 3: High-risk

- The last tier is the tier we don’t want to be in. Rates soar way higher. As a result this group might let their coverage lapse often and never recover from it. They have many accidents and violations, and possibly lower credit scores. Improvement is always possible, but it will take a lot of time, as accidents and violations stay on your record for over 6 years.

Insurance companies use a variety of information to determine what tier you will be put in. The tier is what is referenced to give you a premium and decide what discounts you do or do not have.

The catch for insurance companies here is that they have to figure out how to they are going to compute a rate that is reasonable to you, allows them to make a profit, and compete with other insurance companies. As a result, no one insurance company uses the same system or process to create premium rates. One insurance company might raise your premium for owning a specific car, or living in a specific area, while a different insurance provider will not.

This takes us to our last reason you should regularly shop for insurance.

3. Minor Technicalities Can Drive Up Premiums

As mentioned above, insurance companies don’t all use the same systems to calculate your insurance premium. This is just one way your insurance premium could be lowered when switching between insurance companies.

This last reason to shop for new insurance policy doesn’t necessarily mean you need to switch companies, it could be corrected with something as simple as rewriting the policy with the same company.

If You Bought Your Insurance At The Dealership:

It could be the case that when buying your car, you prefer the convenience of getting insurance on the spot. If this is you, there isn’t anything wrong with this, you just need to consider the depreciation of your vehicle. As soon as you drive your car off the lot, and put more miles on it, the price of it will drastically drop. This may not be reflected on the insurance policy.

Additionally, even after you drive off the lot, within the first 5 years of when you bought the vehicle, the price of your car can drop 60%. (Nicole) Meaning that a $50,000 car can end up being $20,000. This is important because the premise of insurance coverage is to allow you to recover from a loss, as if it had never happened. The depreciation of a newer vehicle should definitely be accounted for by insurance companies.

You undoubtedly still need insurance, as in most jurisdictions, like in Texas, there is only a short grace period to drive a newly bought vehicle without insurance, which may be covered by any current policies in your name. (Texas)

Raised Credit Score:

Insurance companies will usually perform soft credit checks into your history when giving you a quote. This means that being in good standing with your credit, and paying down debt ahead of time can boost your chances of getting lower rates.

Unfortunately doing these credit checks incurs a cost to insurance providers, so they don’t typically do them regularly. Like a new car that depreciates after a couple years, if you stay with one insurance policy for a long time, your credit changes may not be reflected in your policy rate.

Shopping around for a quote when you know your credit has improved significantly would be a good move if you want to reap the full benefits of your position. Or maybe this can clue you in if you should wait for your credit to improve before shopping.

Other Life Events:

Moving locations, purchasing a home, getting married. These are all changes that can affect your rate.

When it comes to getting married or buying a home, prices will usually drop. The reason for this is that the statistical data gives reason to believe that insuring these certain type of people carries less risk than others.

It comes right back to keeping insurance companies accountable to changes that should lower your rate but aren’t processed unless you re-quote your policy.

The Bottom Line Is: If You Want To Save Money You Should Be Shopping For Insurance Every Renewal Period

If you want to be really diligent or simply need to save as much as you can, you should shop new insurance every six months, for auto policies (which is the normal policy length for personal auto). Then for home policies, which have a yearly policy renewal should be used which is the usual personal auto coverage period before renewals. Insurance for other assets and property follows the same principle.

You don’t want to switch insurance policies between policy periods unless you have to, as there is no guarantee that you will be refunded everything you haven’t paid. Not to mention you have to abide contractual agreements.

You might be thinking that this is a hassle to deal with, which it can be, but some Insurance Agencies can assist you and let you know when you should be looking for a new policy. This is something Soliz Insurance Agency of Texas would be happy to help you with. We monitor your policy before every renewal period. If your renewal increases over 20% it’s initial price we get in contact with you and start looking for a better deal you can feel secure taking.

References

Texas. “Automobile Insurance Guide.” Tdi.texas.gov, Texas State Government, www.tdi.texas.gov/pubs/consumer/cb020.html.

Arata, Nicole. “Managing the Hidden Costs of Car Depreciation.” NerdWallet, 17 July 2017, www.nerdwallet.com/article/insurance/car-depreciation#:~:text=Your%20car’s%20value%20decreases%20around,more%20of%20their%20initial%20value.